The €10B Corporate Payments Opportunity Mobile Schemes Are Missing

This article is part of a series on programmable authorization for corporate payments.

If you're running a mobile payment scheme in Europe, you've built merchant acceptance infrastructure, onboarded users, and created a payment experience that's faster and more convenient than legacy cards. But there's a massive market segment you're likely not capturing: corporate expense spend.

The reason has nothing to do with merchant acceptance or user experience. It's about one missing capability: spending controls.

The Corporate B2B Landscape

Let's establish the scale of the opportunity:

The European Corporate Payments Market (rough estimates for context):

- ~200M employed people in the EEA

- ~40% work for companies that issue corporate payment instruments

- = 80M potential corporate users

- Corporate expense transactions typically range from €50-500 (meals, transport, supplies, fuel)

- Frequency: 10-20 transactions per month for employees with active corporate payment instruments

- Cross-border transactions within Europe often carry FX markups of 1-3% on legacy card programs

This isn't consumer discretionary spending, it's mandated by employers. When a company decides to issue corporate payment instruments to employees, those employees must use them for business expenses. It's guaranteed volume, not optional adoption.

The revenue opportunity: Corporate clients value spending controls and real-time policy enforcement, which creates opportunities for platform-based pricing models beyond pure transaction fees. The exact economics depend on your scheme's cost structure, competitive positioning, and value proposition to corporate treasurers.

Key value drivers for corporate clients:

- Reduced expense leakage (unauthorized or off-policy spend)

- Lower FX costs for cross-border operations (especially for multi-country schemes)

- Simplified reconciliation and reduced finance team overhead

- Real-time budget tracking and compliance

- High switching costs once integrated (corporate policy engines built on your APIs represent 6-12 month IT projects)

Why Corporate Treasurers Won't Use Mobile Wallets Today

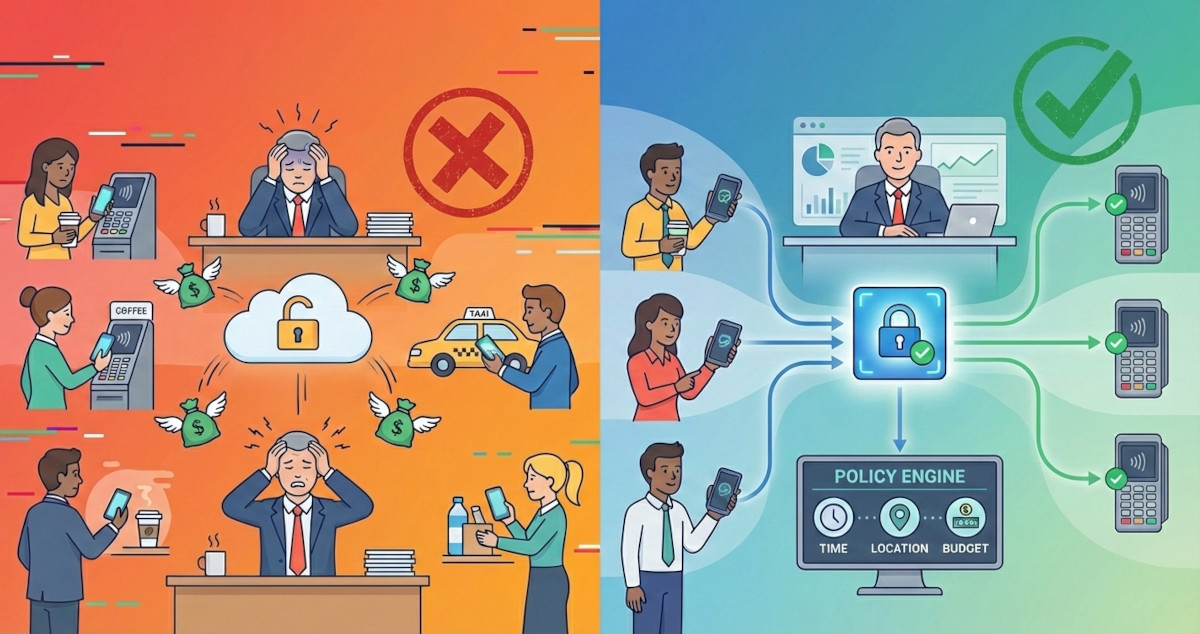

The blocker isn't technical: it's about control.

What CFOs Get with Corporate Cards

When a company issues Visa/Mastercard corporate cards, the CFO gets (limited) spending controls:

- Daily/monthly spending limits per employee

- Merchant category restrictions ("fuel only," "no cash withdrawals," "business travel only")

- Geographic restrictions (domestic only, or specific countries)

- Transaction-level reporting with expense categories

- Ability to freeze cards instantly

It's not sophisticated, but it's something. The CFO can say "drivers can fuel company vehicles during work hours, but can't use the card on weekends."

What CFOs Get with Current Mobile Wallets

When a company tries to use a mobile payment scheme for corporate spend today:

- An account or wallet they can fund

- Transaction history (after money has left)

- Zero ability to enforce spending policies before the payment executes

There's no hook to say "decline this €80 fuel purchase because it's Saturday and the driver is off-duty" or "require manager approval for purchases over €500."

The payments are instant, which is great for consumer UX. But there's no decision point where corporate policy can intervene before the money moves.

From a CFO's perspective:

- a corporate card is a restricted company credit line with controls

- a mobile wallet (currently) means employees spending from the company account with zero oversight

This is non-negotiable for corporate treasury. No matter how good your merchant acceptance or user experience, without spending controls, mobile payment schemes can't compete for corporate expense spend.

The Missing Piece: Pre-Payment Authorization

The good news is that you don't need to rebuild your platform or sign new merchant agreements.

You need to add one architectural change: a decisioning step before forwarding the issuer's authorization approval back to the acquirer.

Current flow (instant payment without controls):

- Employee scans merchant QR code (€120 restaurant)

- Issuer checks account/wallet balance (€500 available)

- Authorization request approved and returned to acquirer

- Acquirer forwards authorization approval to merchant

- Done

New flow (with corporate authorization approval):

- Employee scans merchant QR code (€120 restaurant)

- Platform detects: This is a corporate sub-account

- PAUSE (don't initiate payment yet)

- Call corporate policy API: "Should employee_42 be allowed to spend €120 at this restaurant right now?"

- Corporate system checks:

- Is employee on an active shift?

- Is this during approved expense hours?

- Is there budget remaining in 'Meals' category?

- Is the merchant in an approved category?

- Corporate API responds: APPROVED or DECLINED

- If declined → show employee why ("Off-duty meal purchase not authorized")

- If approved → forward authorization request to issuer and proceed with normal flow

From the employee's perspective: Near-identical UX—scan QR, payment confirms or declines in seconds.

From the CFO's perspective: They just got the spending controls they need to adopt your platform for corporate expenses.

The Sub-Account Architecture

The key innovation isn't moving money in real-time—it's routing authorization logic before the payment executes.

Corporate Account Structure

Instead of separate funded wallets for each employee, use a sub-account model:

Company level:

- Single main corporate bank account (or multiple accounts if they prefer different banks/currencies)

- All corporate funds stay in this account under corporate treasury control

Scheme level:

- Virtual sub-accounts for each employee, use case, or expense category

- Each sub-account has independent authorization rules

- Payments from any sub-account settle from the designated main corporate account

- Sub-accounts don't need pre-funding—authorization logic determines if payment should be allowed

Benefits:

- Capital efficiency: All money stays in corporate's main account where it can earn yield

- Treasury control: Company maintains single-account visibility and reconciliation

- Policy flexibility: Each sub-account can have different authorization logic (drivers have fuel-only rules, consultants have meal expense rules, etc.)

- Fraud prevention: If an employee's credentials are compromised, attacker can't drain a pre-funded wallet—each transaction still requires authorization approval

How Settlement Works

- Employee #42 makes approved €120 restaurant purchase

- Authorization approved by corporate policy API

- Scheme initiates payment to merchant from corporate main account

- Corporate's bank account shows: "Payment to Restaurant XYZ - Employee #42 - Meals category"

- Corporate's finance system auto-reconciles using transaction metadata

The employee experiences a payment "from their corporate account," but technically it's a scheme-level routing decision that settles from the company's main account based on authorization approval.

What This Unlocks for Corporate Treasurers

Adding pre-payment authorization transforms your value proposition from:

Before: "We're a faster, more convenient payment method"

After: "We're a corporate expense management platform with real-time spending controls"

Dynamic Spending Policies

- "Drivers can make fuel purchases Monday-Friday 6AM-8PM only"

- "Consultants can expense meals up to €75/person during active client engagements"

- "Project managers can purchase supplies up to remaining project budget"

- "Sales team can expense client entertainment with manager pre-approval"

Value: Proactive policy enforcement, zero expense leakage

Intelligent Routing to Funding Sources

For companies with complex treasury operations, the pre-authorization step can determine which bank account or funding source the payment should settle from:

- Currency-based routing: EUR expenses settle from EUR account, GBP from GBP account

- Project-based routing: Route to different accounts based on project budgets or cost centers

- Crypto-fiat routing: Companies holding stablecoins can liquidate to fiat for specific transaction types

- Multi-bank treasury: Route to different banks based on relationship requirements or cash management policies

Value: Automated treasury operations, compliance with internal accounting rules

Real-Time Approval Workflows

- Employee may submit approval requests via push notification for excepational purchases, such as €1000 in materials

- Manager approves via mobile app

- Employee proceeds to checkout and pays for pre-approved exceptional purchase

- Purchase request is matched to existing manager approval and goes through

- Without manager pre-approval, transaction would decline with clear reason: "Requires manager approval"

Value: Control without bureaucracy, documented approval trail

Budget Tracking in Real-Time

- Each sub-account can track against category budgets (meals, travel, supplies)

- Authorization logic checks remaining budget before approval

- Corporate finance dashboard shows real-time spend vs. budget

- Automatic alerts when approaching budget limits

Value: No month-end surprises, proactive budget management

Simplified Reconciliation

- Each transaction includes metadata: employee ID, expense category, sub-account

- Corporate finance system receives transaction feed in real-time

- Automatic categorization and assignment to cost centers

- Eliminates manual expense reports for policy-compliant purchases

Value: Massive reduction in finance team overhead

The Revenue Model Opportunity

This isn't just about transaction volume. It's about revenue model diversification.

Transaction-based models (typical for payment schemes):

- Revenue tied directly to transaction volume

- Competitive pressure on per-transaction fees

- Merchants or users pay per transaction

Platform-based models (enabled by corporate authorization):

- Recurring platform fees for corporate clients (value-based pricing for authorization infrastructure)

- Per-employee or per-sub-account fees (scales with client size, not just transaction volume)

- Transaction fees (corporate clients often less price-sensitive than consumer segment)

- Potential premium services (decision logic hosting, policy templates, advanced analytics)

The business model can shift from pure transaction processing to platform-as-a-service with recurring revenue and high customer lifetime value. Corporate clients represent multi-year relationships with significant switching costs once their expense policies are built on your authorization APIs.

Why Now? The Regulatory and Market Tailwinds

SEPA Instant Mandate

SEPA Instant Payments are mandatory for all banks in the Eurozone, with Non-Eurozone banks following in 2027. This creates competitive pressure:

- Corporates will ask: "Why are we paying card fees when instant transfers work everywhere?"

- But they'll still need spending controls → whoever adds authorization capabilities first wins

Cross-Border Corporate Operations

For multi-country payment schemes operating across multiple European markets, there's a unique opportunity rooted in the structural limitations of corporate cards.

Why "one card everywhere" doesn't work:

- Currency fees: A German employee using a US Dollar corporate card pays 2-3% FX fees on every Euro transaction: these costs compound rapidly across hundreds of employees

- Regulatory constraints: Financial regulations often require credit products to be issued by locally-licensed entities; a US credit line issued to a French resident may violate banking laws

- Data sovereignty: EU (GDPR) and other jurisdictions restrict financial data from leaving their borders, complicating centralized card programs

The corporate card trade-off: Companies operating across borders must choose between two imperfect options:

- Global card program: Unified dashboard and reporting, but cards are still issued locally through regional branches or partner banks. Coverage gaps exist in "difficult" jurisdictions, and you're locked into one vendor's acceptance network.

- Multiple local programs: Better local acceptance and redundancy, but fragmented data (5 statements in 5 formats), administrative bloat managing multiple bank relationships, and no unified policy enforcement.

Neither option solves the core problem: real-time spending controls that work consistently across all countries.

The mobile scheme opportunity: A logistics company with operations in Austria, Germany, and Switzerland needs one platform that works across all markets. With sub-account architecture:

- Single corporate account with sub-accounts for employees across all operating countries

- Unified policy enforcement: the same authorization rules apply whether the employee is in Vienna, Munich, or Zurich

- No FX complexity for intra-currency transactions (EUR across the Eurozone)

- One dashboard, one API integration, one relationship

This is a competitive moat that single-country schemes can't easily replicate: it requires regulatory licenses, banking relationships, and merchant acceptance across multiple jurisdictions.

PSD3 and Enhanced Authentication

PSD3 (upcoming Payment Services Directive 3) will require stronger fraud controls. Mobile payment schemes can leverage this:

- Offer "corporate authentication" in the employee's existing mobile app

- Biometric authentication (Face ID, Touch ID) for high-value purchases

- Delegated authentication to corporate policy engines with full audit trail

This makes your platform more compliant than legacy corporate cards, not less.

The Distribution Advantage

Unlike card schemes or fintech challengers trying to enter corporate payments from scratch, mobile payment schemes already have critical infrastructure:

Merchant acceptance:

- You've already signed merchant agreements

- Merchants in your operating markets already accept your payment method (QR codes, app integration, etc.)

- Corporate transactions work at the same merchants as consumer payments

- No new merchant integrations needed

User accessibility:

- Many potential corporate users may already have your app (even if adoption isn't universal)

- Employees can use the same familiar payment UX they may have seen before

Technical infrastructure:

- Payment rails are built (instant payments, settlement infrastructure)

- Compliance frameworks exist (PSD2/PSD3, AML, KYC)

- Banking relationships established

What you need to add:

- Authorization approval gate with corporate policy support

- Sub-account architecture and routing logic

- Corporate dashboard for policy management and reporting

- Developer toolkit for corporate integrations

This is primarily software development, not infrastructure buildout or regulatory licensing from scratch. 6-12 months to launch, not years.

The Strategic Wedge: B2B2C Distribution

Here's the market entry playbook:

Phase 1: Sell to Corporate CFOs (B2B)

- Target: Mid-market companies (500-5,000 employees) with pain around expense control

- Pitch: "Give your employees payment instruments with real-time spending controls. Enforce policies before money moves. Zero expense leakage."

- CFO says yes → company mandates employees use your scheme for corporate expenses

Phase 2: Build Usage Habits Through Mandated Corporate Use (B2B → B)

- Employees now use your scheme regularly for work expenses (15-20 transactions/month)

- They experience: instant approvals, clear decline reasons, seamless UX

- They realize: "This works really well for payments"

- They become familiar with your scheme through daily corporate usage

Phase 3: Potential Expansion to Personal Use (B → C)

- Employees who became familiar with your scheme through corporate use may choose to use it for personal payments too (if your scheme offers consumer products)

- This is optional—the corporate business stands on its own merits

- But it creates a potential pathway: corporate adoption → employee familiarity → potential personal usage growth

Result: One corporate client generates:

- Direct revenue (platform fees, sub-account fees, transaction fees)

- Potential indirect growth (employees who become familiar may increase usage if they weren't already users)

- Merchant volume growth (more corporate transactions strengthen merchant value proposition)

What This Requires (Technically)

The good news: This is mostly software development, not new infrastructure.

Core components needed:

- Authorization approval with support to call corporate policy APIs before payment execution

- Sub-account architecture at scheme level with routing logic to designated corporate accounts

- Transaction metadata enrichment (pass merchant category, location, name to corporate API—basic contextual data, not detailed line items)

- Developer toolkit for corporate clients to build policy engines, with SDK and sandbox environment

- Corporate dashboard for policy configuration, reporting, and account management

What you DON'T need:

- New payment rails (use existing instant payment infrastructure)

- New merchant agreements (use existing acceptance network)

- New regulatory approvals (if you already operate as a payment scheme)

- New settlement processes (leverage existing account-based settlement)

Timeline: 6-12 months to build core platform, 3-6 months to pilot with initial corporate clients, 12-18 months to scale to meaningful corporate client base.

Investment: Primarily engineering and product development resources, plus go-to-market for corporate sales (different from consumer marketing).

Return: Depends on your pricing model, target market size, and competitive positioning. Use the market sizing data above (80M potential users, 10-20 transactions/month, €50-500 average basket) to model revenue for your specific economics.

The Competitive Window

Who else is positioned to do this?

- Card networks: Trapped by legacy infrastructure and issuer bank relationships

- Fintech challengers: Don't have your merchant acceptance (need to build from zero)

- Banks: Too slow to innovate (18-24 month feature cycles)

- Other mobile payment schemes: Your direct competitors—whoever moves first wins

First-mover advantage is significant because:

- Corporate policy engines become sticky (built on your APIs, high switching cost)

- Employee usage habits form (familiarity breeds continued use)

- Network effects accelerate (more corporate volume → better merchant relationships → better service levels)

- Market lockup: Once a corporate with 5,000 employees builds their expense policies on your API, switching to a competitor means rebuilding everything

Window: 12-24 months before competitors (likely other mobile payment schemes or specialized fintechs) figure this out and start winning corporate clients.

Strategic positioning:

- Single-country schemes: Can dominate their home market for domestic corporates

- Multi-country schemes: Can target pan-regional corporates, addressing a segment that single-country schemes can't serve efficiently

- Cross-border advantage: Companies operating across your supported countries get unified expense management, which is a unique value proposition

The race is to establish your corporate market position before a competitor does.

The Pitch to Your Board

If you're a mobile payment scheme executive considering this opportunity, here's the strategic case:

Problem: We have merchant acceptance and payment infrastructure, but we're not capturing corporate expense spend, which represents €120B annual volume in Europe.

Root cause: Corporates need spending controls before payments execute. Our instant payment model has no authorization approval logic step.

Solution: Add pre-payment authorization approval with sub-account architecture and corporate policy API integration.

Investment: 6-12 months of engineering effort (primarily backend development, API design, security infrastructure).

Return:

- Platform-based recurring revenue model (not just per-transaction fees)

- Multi-year corporate client relationships with high lifetime value

- Revenue scales with client size (employee count) and transaction volume

- Opportunity to capture share of €120B+ annual European corporate payment market

Strategic moat: First mover in corporate B2B for our markets, with sticky API integrations and high switching costs.

Risk if we don't: A competitor (another scheme or fintech) builds this capability, wins the corporate market, and uses that revenue to expand into our merchant network.

In the next post, we'll talk more about the technical architecture for pre-payment authorization approvals: the sub-account model, corporate policy integration patterns, and the developer experience that makes corporate clients successful.

This article is part of a series on programmable authorization for corporate payments.